Throughout: The Ultimate Roadmap to GST Enrollment for Companies Looking For Financial Stability

Browsing the complexities of Product and Provider Tax (GST) registration is an essential action for services striving for economic stability. From recognizing the essential concepts of GST to adhering to post-registration guidelines, the process can appear daunting initially look. Breaking down the roadmap into workable actions can enhance the registration trip for businesses looking to enhance their economic standing. Allow's discover the essential elements that comprise this supreme roadmap and discover how each stage adds to laying a solid foundation for monetary success.

Understanding GST Fundamentals

Looking into the essential concepts of Goods and Solutions Tax Obligation (GST) is necessary for acquiring a thorough understanding of its implications on companies and the economic climate. GST is a value-added tax obligation levied on most products and solutions for domestic consumption. It has replaced multiple indirect tax obligations that existed in the pre-GST period, enhancing the tax structure and boosting simplicity of doing business in India. Under the GST system, both services and items are exhausted at a specific price, which is established based on their category. If their yearly turnover exceeds the threshold restriction set by the government, businesses are called for to sign up for GST. Input Tax Credit Rating (ITC) is a substantial attribute of GST, permitting organizations to claim credit history for tax obligations paid on inputs, reducing the overall tax burden. Comprehending the fundamentals of GST is essential for businesses to follow tax obligation guidelines, manage their finances efficiently, and add to the country's financial growth by participating in a clear tax obligation system.

Eligibility Standards for Enrollment

As of the existing laws, the threshold limit for GST enrollment is a yearly accumulation turn over of 40 lakhs for services running within a state, other than for special classification states where the limitation is 20 lakhs. In addition, particular companies are required to sign up for GST irrespective of their turnover, such as interstate providers, laid-back taxed persons, and companies liable to pay tax under the reverse fee mechanism. It is crucial for companies to thoroughly evaluate their turnover and transaction types site link to establish their GST enrollment responsibilities precisely.

Records Required for Enrollment

Having satisfied the eligibility criteria for GST registration, companies should now ensure they have the requisite files in place to proceed with the enrollment procedure effectively. The papers required for GST enrollment commonly consist of proof of company constitution, such as partnership deed, enrollment certification, or incorporation certification for different types of services. Additionally, organizations need to provide files establishing the major location of company, such as a rental agreement or electrical energy bill.

Step-by-Step Enrollment Refine

Commencing the GST enrollment procedure involves a series of organized actions to ensure a seamless and certified Clicking Here registration for organizations. The primary step is to check out the GST portal and load out the registration kind with accurate information of the company entity. Following this, the applicant receives a Momentary Reference Number (TRN) which is made use of to resume the application process if it's not completed in one go.

Next, all called for documents as per the checklist supplied by the GST portal demand to be uploaded. These files commonly include proof of business address, registration and identity proofs of marketers, economic declarations, and organization entity's PAN card.

Post-Registration Compliance Standards

Conclusion

Finally, services looking for financial stability must recognize the basics of GST, fulfill eligibility standards, collect essential records, adhere to the detailed registration procedure, and abide by post-registration standards - Best GST registration services in Singapore. By sticking to these steps, services can make sure conformity with tax policies and keep financial stability over time

Additionally, specific companies are needed to register for GST regardless of their turn over, such as interstate providers, laid-back taxable persons, and organizations accountable to pay tax under the reverse charge device.Having actually fulfilled the qualification standards for GST enrollment, organizations need to now guarantee they have the requisite papers in location to proceed with the enrollment procedure efficiently. The files needed for GST registration generally include evidence of business constitution, such as collaboration deed, enrollment certificate, or incorporation certification for different kinds of organizations. Additionally, organizations require to give papers developing the principal location of service, such as a rental arrangement or electrical energy costs.Starting the GST registration process entails a collection of organized actions to make sure a smooth and certified registration for services.

Richard "Little Hercules" Sandrak Then & Now!

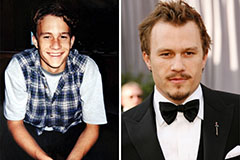

Richard "Little Hercules" Sandrak Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!